The Economy

Sources

Search

Contact

Home

The post Civil War economy in New Orleans is extremely complex. It sits at the confluence of many social currents including monetary collapses, taxation, Reconstruction, financial panics, and fights over hard currency. It is not enough just to realize that it played a role in the creation of the Morgan Dollar. A Mint employee came to work each day with a number of issues on their mind that had little to do with their job.

Historical Context

Louisiana Economy

Panic of 1873

To understand the environment in New Orleans you must mix issues like the Civil War, occupation, Reconstruction, the Financial Panic of 1873, and the Yellow Fever Epidemics in 1867 and 1878. The reopening of the Mint did not happen in a vacuum but against a backdrop of many financial, political, and environmental issues.

Perhaps the one common denominator for all New Orleans residents was the economy. Having lived under occupation by the Union from 1862 until 1879 the residents would have had an economy that already operated on U. S. currency and specie before the end of the War in 1865.

As a port city and shipping hub the local economy would have been tied to many other regions up the Mississippi River and beyond. Reopening New Orleans to trade was as important to the Union as its loss was to the Confederacy. But reopening the port was only one factor influencing the local economy.

As a port city and shipping hub the local economy would have been tied to many other regions up the Mississippi River and beyond. Reopening New Orleans to trade was as important to the Union as its loss was to the Confederacy. But reopening the port was only one factor influencing the local economy.

Financing the War

One interesting fact about the financing of the Civil War for the North was that the United States did not really know how to tax. The nation was founded assuming the Federal Government would derive the money it needed to operate from "Taxes, Duties, Imposts, and Excises." Supplementing those funds were income from the sale of western lands as the nation expanded.

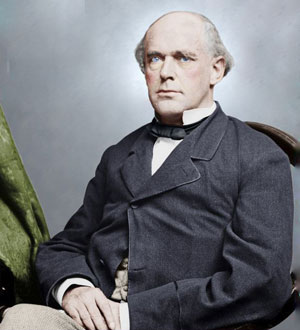

Salmon P. Chase, the new Secretary of the Treasury, found that he had inherited a treasury that was essentially bankrupt. He had about $2 million on hand and Congress had appropriated something closer to $20 million. He thought he might need as much as $320 million to finance the war. Little did he know that he might need closer to $900 million annually to do the job. Congress often approved taxation bills thinking that the war would end just any day, so temporary measures were always easily approved.

Currency

One big issue for the Union was that bank notes were issued at the State level, and often were confusing and were easily counterfeited. Adding to the problems was hoarding of hard currency by citizens in anticipation of difficult times. With the money supply "drying up," Changes had to be made to keep the economy working.

In 1862 the Union issued its first "greenbacks" which were in effect paper money backed by the good faith of the Country and not gold or silver. The new currency actually changed value with speculators based on the success or failure of battles and views of the war's outcome changed. In July of 1863 just before the first Battle of Gettysburg, it took almost 3 greenbacks to equal just 1 specie backed dollar. Another important piece of legislation was the National Banking Act of 1863 which made improvements in standardization of many banking functions.

Excise Taxes

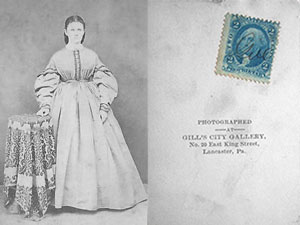

While the Constitution assumes wars, it does not spell out exactly how to tax or collect. When excise taxes were needed the preferred method of the day was stamps. So to finance the war the U. S. Government started taxing just about everything it could affix a stamp to without it falling off. When you see an old photograph or document with a tax stamp on it in all likelihood it was in some way involved in the financing of the war.

But mass taxation through stamps was new and ineffectual. If you took all the taxes collected from stamps during the war and added them together they equaled less than the cost of one year's fighting. So other forms of financing had to be invented, and rapidly.

Income Taxes

The many failures at taxes like excise and tariffs to raise enough money to finance the war led to measures in 1862 to have an income tax of 3% on all incomes in excess of $800. There were even higher rates on incomes over $10,000, but this was a very large figure for the day. But it was a time when record keeping was at best rudimentary and the desire to evade the tax was great. So the income tax only met with limited success.

Bonds

Bonds became an all together different but difficult to deal with. In 1860 the United States was essentially bankrupt. This placed real pressure on the sale of bonds and they often commanded as much as 12% interest if they could be sold at all. There is no wonder that issuing the "Greenbacks" looked to be one of the few viable solutions to the war financing woes.

There were many changes in the South that created tension between the old Confederate States and the reconstituted Union. During Reconstruction additional taxes had to be raised to pay for new spending on schools and the repair of infrastructure. Large land owners were forced to pay the bulk of the increase because States relied on property taxes, as they do now. Large land owners were often unable to pay the taxes, so land was confiscated and often redistributed or sold off.

While this seems reasonable when taxes were not paid, one of the unintended consequences was that small farmers were now placed in competition with new farmers who owned portions of former large plantations.

While this seems reasonable when taxes were not paid, one of the unintended consequences was that small farmers were now placed in competition with new farmers who owned portions of former large plantations.

And then came the Panic of 1873 to compound the issues. The Panic led to a reduction in wages, bankruptcies, labor strikes, and other violent conflicts including a resurgence of the Ku Klux Klan.

In Louisiana nothing shows the tensions and conflicts that existed more than the event known as The Colfax Massacre. With all the change brought on during Reconstruction, Louisiana whites had formed a sort of shadow government known as the White league. The massacre occurred in 1873 and pitted the White League against the Louisiana State Militia (which was almost all black). When the smoke cleared over 100 members of the State Militia were dead.

The U. S. economy, collapse of the CSA economy, black suffrage, land redistribution, higher taxes, carpetbaggers, the White League, shadow governments, pitched battles, and we are sure many other tensions all provided a backdrop for the reopening of the Mint.

The U. S. economy, collapse of the CSA economy, black suffrage, land redistribution, higher taxes, carpetbaggers, the White League, shadow governments, pitched battles, and we are sure many other tensions all provided a backdrop for the reopening of the Mint.

But not all was bleak in 1881 in New Orleans. The port was recovering and cotton again exported in large quantities. There also were new industrialized businesses and a new Cotton Exchange building built. New Orleans was also just three years away from the recognition of hosting the World Industrial and Cotton Exposition.

But not all was bleak in 1881 in New Orleans. The port was recovering and cotton again exported in large quantities. There also were new industrialized businesses and a new Cotton Exchange building built. New Orleans was also just three years away from the recognition of hosting the World Industrial and Cotton Exposition.

Post-War National Economy

Even with its occasional economic hiccups, America was undergoing a post Civil War political transformation during and after Reconstruction. The women's movement was gaining some steam, and the last remnants of Indian resistance was ending in the West. Nationally the U. S. was experiencing a technological, cultural, and economic shift that brought the country into the modern age. Changes in mass communication changed the way people interacted with each other locally and nationally. The many innovations of the time period also carried with them far-reaching effects on the way Americans lived, thanks in no small part to inventors like Thomas Edison. More people lived and worked in cities, and cities grew exponentially in all regions. The period between the 1870s and World War I was one of significant change.

Production with the use of steam and later electricity boosted production everywhere. Inventions like the Bessemer process helped steel replace iron as our primary building material. For the first time oil was used to light homes and businesses, as well as to lubricate machines of all sizes and uses. Technological advancements such as the telephone, the typewriter, and the adding machine were right around the corner. Vast miles of railroad track was being laid. Steel plows and new farm equipment made farming a more efficient occupation. Collectively these technological advancements fueled the drive for westward expansion.

While society was changing, so too was the labor movement and the nature of politics of the era. Smaller trade unions that formed before the Civil War were evolving into national unions by the 1880s and 90s. With rising membership, much spurred by the 1877 Railroad Strikes, these national unions were fighting for a number of common goals. Among those were a minimum and living wage, safer work conditions, and the recognized right to unionize. But unions had many opponents, especially in the industrial and business community. This industrial era was marred by frequent conflict between organized labor and business. Many conflicts involved labor strikes that affected hundreds or thousands of people and, in some rare cases, the nation as a whole.

Democrats and Republicans of the era stood essentially for uncontrolled capitalism, and the support of business rights to be free from government interference. The influx of masses of immigrants from eastern Europe and Russia, brought new political ideas that were embraced within the labor movement and stood in stark contrast to the established order. Socialism in particular caught on resulting ultimately in the formation of a powerful political party that influenced national political discourse and elections.

Further, new political parties such as the Populist Party were formed to counter what many saw as a limited choice in Democrats and Republicans. The Populists advocated for the abolition of national banks, graduated income taxes, an eight hour work day, Government control of large industry, and Federal storehouses for key commodities. We see many of these platform ideas in play today, primarily in the Democratic Party who started to co-opt the ideas in the late 1800s and early 1900s.

Further, new political parties such as the Populist Party were formed to counter what many saw as a limited choice in Democrats and Republicans. The Populists advocated for the abolition of national banks, graduated income taxes, an eight hour work day, Government control of large industry, and Federal storehouses for key commodities. We see many of these platform ideas in play today, primarily in the Democratic Party who started to co-opt the ideas in the late 1800s and early 1900s.

To say the least it was a turbulent time for the Nation as we sorted things our after the Civil War. Much more turbulent than today, which we find difficult to imagine.

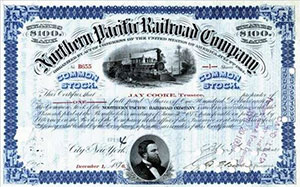

The Financial Panic of 1873 hit the Southern economy hard at a time that there was little resilience. Many businessmen believed that railroads would pull the South and the nation out of its poverty and post-war stagnation. In the South the price of cotton had fallen sharply; forcing many smaller landowners, merchants and cotton factors into bankruptcy.

Nationally the railroads had been seen as the savior for the economy. The first transcontinental railroad was completed in 1869. But the financiers of this and other railroad ventures discovered that they had overextended themselves and had to declare bankruptcy. This started a domino effect where other railroad financiers also went under.

The ultimate effect of all this was that roughly 25% of all railroads in the Country went bankrupt. Another 18,000+ businesses went under because of either direct or indirect dependency on the railroads. And by 1876 it is estimated that unemployment had risen to 14%. All of this served to contract the money supply and create a panic.

The ultimate effect of all this was that roughly 25% of all railroads in the Country went bankrupt. Another 18,000+ businesses went under because of either direct or indirect dependency on the railroads. And by 1876 it is estimated that unemployment had risen to 14%. All of this served to contract the money supply and create a panic.

The nation did not get out of this economic malaise until 1879, an interesting connection to the creation of the Morgan Dollar in 1878 and a corresponding increase in circulating currency. So increasing the money supply does have the desired reaction in the economy. This is a lesson not learned in subsequent recession/depression cycles until 2008.

The nation did not get out of this economic malaise until 1879, an interesting connection to the creation of the Morgan Dollar in 1878 and a corresponding increase in circulating currency. So increasing the money supply does have the desired reaction in the economy. This is a lesson not learned in subsequent recession/depression cycles until 2008.

In 2008 with the collapse of the housing industry and resulting loan defaults we saw a similar situation to the 1873 Financial Crisis. Banks were overextended on housing loans, and faulty securities had been created on Wall Street with the help of the Federal Government. When it all started to come apart there was literal panic, much like they saw in 1873. For those of us who lived through it we have a much greater appreciation for those who went through the Great Depression.

The Money Supply

It has been estimated that all of the efforts to finance the war generated no more than 25% of the funds needed. This was a time of hard money currencies and a balanced Federal budget was considered to be desirable. If not completely balanced then one where war debt was always retired at the end of the conflict. So retiring the Civil War debt was a natural desire of the Country as it entered the post war era and reconstruction.

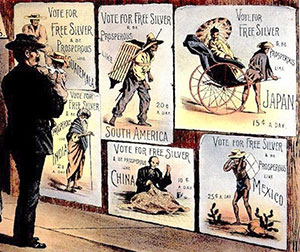

One faulty move made by Congress was to regress to a financial system based solely on gold. The removal of the silver dollar as a part of our monetary system in 1873 only added to the contraction of the money supply. In silver dollar circles, and Morgan Dollar in particular, this money supply contraction is rarely discussed and lost in the discussion of other silver specific issues like the connections to the Comstock Load Mines.

In difficult economic times people also hoard gold and silver as a storehouse of value. During the Civil War hoarding of gold had become a major issue with circulating currency. The lack of coinage contributed to the difficult economic times, but who could blame people amid such uncertainty. Coming just eight years after the end of the war, the Financial Panic of 1873 did not help restore faith in the direction of the Country.

But without the reestablishment of a bi-metal system of currency there was just not enough money in circulation to fuel commerce. Carrying silver is impractical (just put 50 silver dollars in your pocket), but backing paper money with silver was important.

But relying only on gold probably seemed logical to many people, not just politicians. The collapse of the CSA currency, the Financial Panic of 1873, and an unsettled political future for the Country all fueled fear and uncertainty. Through our modern lens things just look different when we try to understand the times.

But relying only on gold probably seemed logical to many people, not just politicians. The collapse of the CSA currency, the Financial Panic of 1873, and an unsettled political future for the Country all fueled fear and uncertainty. Through our modern lens things just look different when we try to understand the times.

Today with a fiat currency that floats against the price of gold and silver the anxiety of the time is difficult to understand. Silver and gold are still storehouses of worth, but are viewed by many as outdated concepts. However, even today there are hard currency advocates, so the debate rages on. To read the history of the times is like looking in a mirror for the 2008 financial panic, only without the silver versus gold debate.

Today with a fiat currency that floats against the price of gold and silver the anxiety of the time is difficult to understand. Silver and gold are still storehouses of worth, but are viewed by many as outdated concepts. However, even today there are hard currency advocates, so the debate rages on. To read the history of the times is like looking in a mirror for the 2008 financial panic, only without the silver versus gold debate.

The Aging 1D

Submissions

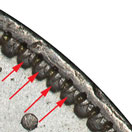

Clashed Denticle

Date Issues

Encyclopedia

New Orleans and the Mint in 1881

The Devolving 5

One and Done

Two and Through

Fakes

Die Fingerprints

Pricing

The Devolving 27

New Orleans and The Mint in 1881

The Civil War

Politics

The Economy

Environment

Organization

Personnel

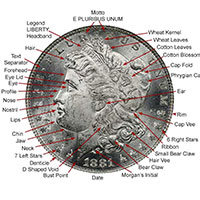

Coinage

The Jobs

Politicians

Getting Started

Collecting The 1881-O

The 1881-O VAMs